Information centre

The latest financial news, information, and resources

- Home

- Posts

- Individuals, Private Health

- Recommendation: Consider/ Obtain Private Health Insurance to avoid Medicare Levy Surcharge

There are a number of government review sites to help you obtain great prices and services. I note Iselect is also a private health comparison site but they accept commissions and I had an absolutely terrible personal situation with Iselect – that I was told false information and then Serious Dental was not on my new plan which I then needed.

Private Health – https://www.privatehealth.gov.au/dynamic/Search

Just FYI – while we are here – other government review sites are (and you can Google them if you lose this email):

Electricity & Gas – https://www.energymadeeasy.gov.au/

NSW Car Green slip – https://www.greenslips.nsw.gov.au/

Cheap Fuel Check – https://www.fuelcheck.nsw.gov.au/app

Find paid carparking & pay on your phone – https://parknpay.nsw.gov.au/

More Information about Private Health

If you earn $140k/$280k – 1.5% you pay $2,100 extra tax (each if couple)

Should I get private health insurance?

With that tax cost, to me it might make more sense to pay an extra amount to be covered for hospital cover if something happens.

Maybe you can claim a few benefits during the year like dental (or even just have hospital cover).

Now though – if you are above the Medicare Levy Surcharge amount ($90k single and $180k couple) – you will need to pay some or all of it back on your (and your spouse’s) tax return.

On the tax return this is called Excess Private Health Entitlement (i.e. if you received $976 rebate received on your private health statement and your combined taxable income is under $180k then 0 is required to be repaid, however if your combined income is above $140k single/ $280k couple you will need to pay the full $976 back in your return). – You can either tell your private health company your income or just pay it back on your tax return.

Regardless of not receiving the full 30% rebate/offset – it it still better to have private health insurance than have to pay 1-1.5% Medicare Levy Surcharge.

Tables and further links below for more information -but hopefully this makes a complex topic more simple to understand.

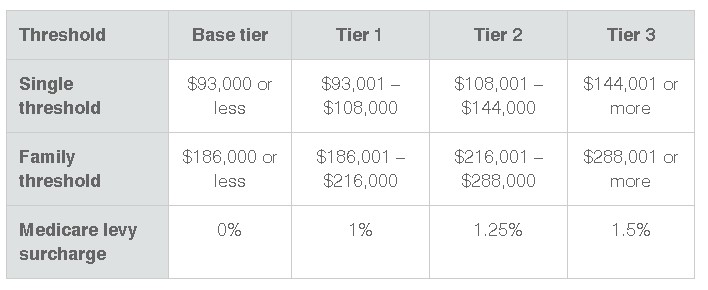

Income threshold and rates 2023–24

These income thresholds and MLS rates apply for the 2023–24 income year.

Use this information to work out which income threshold and MLS rate apply to you.

MLS income thresholds and rates for 2023–24

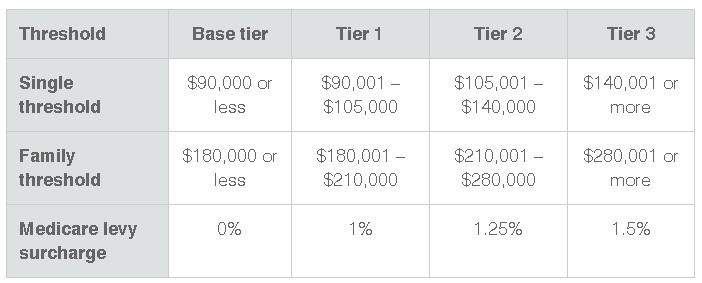

These income thresholds and MLS rates apply for income years from 2014–15 to 2022–23.

Use this information to work out which income threshold and MLS rate apply to you.

MLS income thresholds and rates from 2014–15 to 2022–23

Example: Medicare levy surcharge for a single adult

In the 2022–23 income year, Tom doesn’t have the appropriate level of private patient hospital cover and is:

Tom’s taxable income is $90,000. When Tom completes his tax return, he also completes the income test section and declares total reportable fringe benefits of $27,000.

Tom’s income for MLS purposes is $117,000 ($90,000 taxable income and $27,000 total reportable fringe benefits).

Therefore, Tom is a Tier 2 income earner and the Tier 2 MLS rate that applies to him is 1.25%.

The amount of MLS is calculated on his taxable income of $90,000 and total reportable fringe benefits of $27,000.

Tom’s MLS liability for 2022–23 is $1,462.50 ($117,000 × 1.25%).

See Family and dependants for Medicare levy surcharge purposes for more information about what is considered family and dependant for the MLS.